The Opportunity Zones incentive is a community investment tool established by Congress in the Tax Cuts and Jobs Act of 2017 to encourage long-term investments in low-income urban and rural communities nationwide. Opportunity Zones provide a tax incentive for investors to re-invest their unrealized capital gains into dedicated Opportunity Funds. Investors may defer tax on almost any capital gain up to Dec. 31, 2026 by making an appropriate investment in a zone, making an election after December 21, 2017, and meeting other requirements.

Who Benefits from the Designation of Opportunity Zones?

By driving capital investment and generating economic opportunities, the Opportunity Zones Program benefits individuals, communities, and states. In addition, certain investments made by U.S. investors, like the reinvestment of unrealized capital gains into Opportunity Funds, may benefit from favorable tax treatment and incentives, such as temporary deferrals.

How were opportunity zones established?

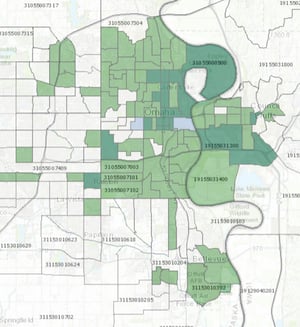

The Tax Cuts and Jobs Act of 2017 authorized the governor of each U.S. state and territory to nominate qualifying census tracts as “Opportunity Zones. 8,761 communities were designated as qualified Opportunity Zones through the nomination process. Opportunity Zones retain their designation for 10 years. The full list of opportunity zones is available here and you can see them visually here.

These are the areas in Omaha and Bellevue, Nebraska

The proposed regulations clarify that almost all capital gains qualify for deferral.

The amount of a capital gain to be deferred must be invested in a Qualified Opportunity Fund (QOF) to qualify for deferral.

Requirements for the QOF:

- The QOF must be an entity treated as a partnership or corporation for Federal tax purposes and organized in any of US state or territory.

- The QOF must hold at least 90 percent of its assets in qualified Opportunity Zone property (investment standard).

- The QOF then has to own qualified opportunity zone property, which is either another corporation or tax partnership that runs a qualified opportunity zone business, or the fund invests in the qualified assets directly.

- The QOF will actually own the qualified property. The fund receives the benefit under the statute, not the underlying qualified opportunity zone property.

Requirements related to the property:

- Substantial Improvement Test

- The regulations require that the property either be new or be substantially improved after being purchased by a QOF.

- This means the QOF must invest at least as much on the improvement as was paid for the used asset.

- The basis of the land need not be counted for purposes of determining whether real property has been substantially improved, thus significantly reducing the required investment amounts.

- Investors must double their adjusted basis in their investment after the initial purchase and during any 30-month period that they hold a qualified opportunity zone property.

- Property must be “substantially all” in a qualified opportunity zone. This requirement can be satisfied if at least 70 percent of the tangible business property owned or leased by a trade or business is qualified opportunity zone business property.

- Not every property is eligible for tax benefits. An opportunity zone fund is required to invest, directly or indirectly, in an income-producing business located in a qualified opportunity zone. Whether a business is eligible may be open to interpretation, depending on its use.

- If the fund holds and operates an apartment building or a shopping center, it has a good case for holding qualified opportunity zone property.

- There are specific categories of businesses that can’t qualify for indirect investment, including private and commercial golf clubs, tanning salons, country clubs, massage parlors, hot tub facilities, gambling facilities and liquor stores.

Tax Benefits

You should talk to your tax advisor about specific options in your area. Investors in qualified opportunity zones can receive both deferral on capital gains taxes on investments the profit of which is rolled over into an opportunity fund (within 180 days of the sale to an unrelated party) as well as an exclusion from tax of up to 15% of those gains. Full exclusion of those gains earned by deferred-gains investments within the opportunity fund is available. Talk to an accountant to get specific how the tax process could work in your situation.

- Investors who hold their Iowa, Nebraska, or South Dakota qualified opportunity investment for at least 10 years may qualify to increase their basis to the fair market value of the investment on the date it is sold.

- In the case of a capital gain experienced by a partnership, the rules allow either a partnership or its partners to elect deferral. Similar rules apply to other pass-through entities.

- Taxpayers can reduce their recognized gain by 10 percent after holding the asset for five years, and by an additional 5 percent after holding it for seven years. The biggest benefit comes at the 10-year mark when the investor will be exempt for any gain that accrued after the original re-investment.

- The opportunity zone program allows individuals and businesses to liquidate a wide variety of appreciated capital assets and to reinvest all or a portion of the gain into qualified opportunity funds within 180 days of triggering the gain. The gain can then be deferred up until Dec. 31, 2026.”

- In addition to deferring gains, taxpayers can reduce their recognized gain by 10 percent after holding the asset for five years, and by an additional 5 percent after holding it for seven years. The biggest benefit comes at the 10-year mark.

Guidance from the IRS:

- The proposed regulations

- The Treasury and the IRS issued Rul. 2018-29regarding the “original use” requirement for land purchased after 2017 in qualified opportunity zones. They also released Form 8996, which investment vehicles will use to self-certify as QOFs.

- IRS Responses to Frequently Asked Questions

Opportunity zone investments in Nebraska, Kansas, and Missouri can be a great way to defer taxes on gains you have made on current real estate investments. However, you should discuss any proposed ideas with your tax planner and ensure you have assistance with the due diligence process. You might also want to consider that taxes are at historical lows, so deferring gains might not be as helpful. However, the ability to reduce recognize gains can be very helpful. For questions, contact an attorney at our Sioux Falls, Sioux City, or Omaha office today.

Angela Madathil is a Real Estate, M&A, and Deal Attorney and provides legal assistance to buyers and sellers of businesses, as well as business brokers in Nebraska, Missouri, and Kansas. This can involve contract review and negotiation, due diligence assistance, and post-sale integration. The Goosmann Law Firm team advises to buyers and sellers of commercial real estate throughout the Midwest and has attorneys licensed in Iowa, Kansas, Minnesota, Missouri, Nebraska, South Dakota, and other states.

Let Us Know What You Thought about this Post.

Put your Comment Below.